Fraud Prevention Security Oversight Enforcement Council 3290492274 3274482563 3756545747 3510833660 3519719817 3711140738

The Fraud Prevention Security Oversight Enforcement Council (FPSOEC) plays a crucial role in enhancing financial security through effective oversight and enforcement of anti-fraud measures. By employing advanced technologies and robust risk assessment frameworks, the FPSOEC significantly improves fraud detection capabilities. This cultivates a secure environment for both consumers and businesses. However, the effectiveness of these initiatives raises questions about their long-term sustainability and adaptability in an ever-evolving financial landscape. What challenges lie ahead?

Overview of the Fraud Prevention Security Oversight Enforcement Council

The Fraud Prevention Security Oversight Enforcement Council (FPSOEC) plays a pivotal role in the landscape of financial security, acting as a regulatory body dedicated to the oversight and enforcement of anti-fraud measures.

Its mandate includes enhancing fraud detection capabilities and implementing robust security measures.

Key Initiatives and Strategies for Fraud Prevention

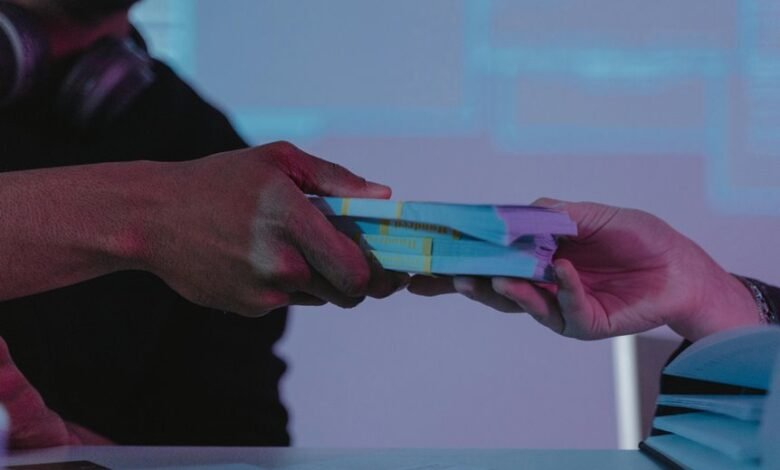

While fraud prevention requires a multifaceted approach, several key initiatives and strategies have emerged as essential components in the fight against financial misconduct.

Effective fraud detection systems are crucial, leveraging advanced technology to identify anomalies.

Additionally, comprehensive risk assessment frameworks enable organizations to evaluate vulnerabilities, thus informing targeted interventions.

These strategies collectively enhance resilience against fraudulent activities, promoting a secure financial environment for stakeholders.

Impact on Consumers and Businesses

Fraud prevention strategies significantly influence both consumers and businesses, shaping their interactions within the financial ecosystem.

Enhanced security measures foster consumer trust, as individuals feel safer engaging with businesses that prioritize their protection.

Conversely, robust fraud prevention initiatives bolster business reputation, mitigating the risk of financial losses and negative publicity.

Thus, a synergistic relationship emerges, benefiting all participants in the marketplace.

The Future of Fraud Prevention and Security Collaboration

Collaboration between businesses and security entities is poised to redefine the landscape of fraud prevention.

By leveraging collaborative technologies and predictive analytics, organizations can enhance their ability to detect and mitigate fraudulent activities.

This synergy fosters a proactive environment where insights are shared, enabling quicker responses to emerging threats.

Ultimately, such partnerships empower both sectors, promoting a more secure and resilient economic framework.

Conclusion

As the Fraud Prevention Security Oversight Enforcement Council continues to refine its strategies and leverage cutting-edge technologies, the stakes in the battle against fraud heighten. Each initiative not only fortifies defenses but also unveils new challenges lurking in the shadows of financial transactions. The ongoing evolution of threats demands vigilance and collaboration among stakeholders. Will the council’s efforts be enough to outpace the cunning tactics of fraudsters? The answer lies in the relentless pursuit of innovation and security.