Fraud Surveillance Intelligence Compliance Oversight Unit 3286965186 3295353086 3384800703 3756232303 3510077494 3516659907

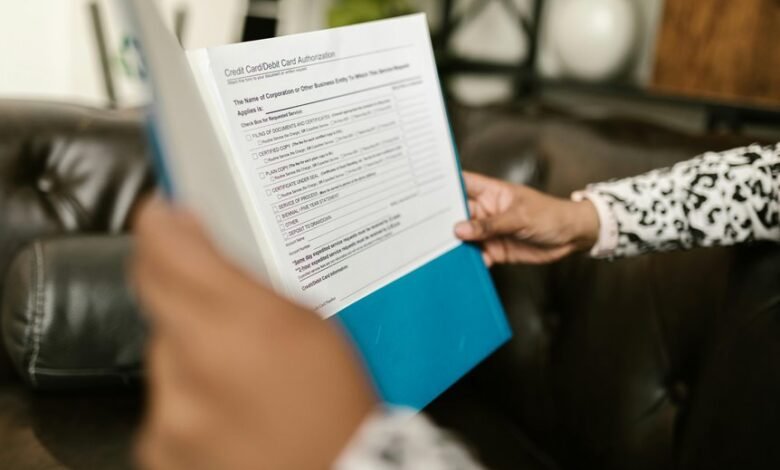

The Fraud Surveillance Intelligence Compliance Oversight Unit, identified by various numeric codes, serves a pivotal role in organizational risk management. Its systematic approach to fraud detection and compliance monitoring is essential for maintaining integrity. By implementing regulatory frameworks, the unit enhances transparency and accountability. Understanding its functions and the impact on both businesses and consumers reveals deeper insights into the complexities of fraud mitigation. What implications does this have for future compliance strategies?

Overview of the Fraud Surveillance Intelligence Compliance Oversight Unit

The Fraud Surveillance Intelligence Compliance Oversight Unit serves as a critical component in the broader framework of organizational integrity and risk management.

Its primary focus lies in enhancing fraud detection mechanisms while ensuring adherence to compliance regulations.

Key Functions and Responsibilities

A comprehensive understanding of the key functions and responsibilities of the Fraud Surveillance Intelligence Compliance Oversight Unit reveals its multifaceted role in organizational governance.

This unit is primarily tasked with fraud detection and compliance monitoring. It systematically analyzes data patterns, establishes regulatory frameworks, and enforces adherence to policies, thereby ensuring operational integrity and fostering an environment conducive to transparency and accountability within the organization.

Importance of Fraud Mitigation Strategies

While organizations may implement various safeguards, the importance of fraud mitigation strategies cannot be overstated in today’s complex business environment.

Effective fraud prevention hinges on comprehensive risk assessment, enabling entities to identify vulnerabilities and allocate resources efficiently.

Impact on Businesses and Consumers

Fraud mitigation strategies play a significant role in shaping the dynamics between businesses and consumers. Effective measures reduce financial losses, fostering a secure environment for transactions.

In turn, heightened security enhances consumer trust, encouraging loyalty and engagement. Conversely, inadequate fraud management erodes trust, leading to potential business setbacks.

Thus, a proactive approach to fraud surveillance is essential for sustainable business-consumer relationships.

Conclusion

In conclusion, the Fraud Surveillance Intelligence Compliance Oversight Unit serves as a critical bulwark against fraudulent activities, enhancing both organizational integrity and consumer trust. For instance, a hypothetical case where a retail company implemented proactive fraud detection measures led to a 40% reduction in fraudulent transactions over a year, demonstrating the unit’s effectiveness. Such results underscore the necessity of robust fraud mitigation strategies, fostering a secure business environment that ultimately benefits all stakeholders involved.